Frequently Asked Questions

- Who can apply for the affordable housing scheme?

In order to be eligible to apply to the scheme applicants must satisfy the below criteria;

- Be classified as a first-time buyer.

- earn up to a maximum of €50,000 gross income in a year for single adult households or,

- earn up to a maximum of €75,000 gross income in a year for households where two or more qualifying adults will own the home.

- have the right to reside indefinitely in Ireland. Intending purchasers from a member state of the EU/European Economic Area can apply for an affordable home, provided they are living and working in Ireland. Where intending purchasers are not an Irish/EU/EEA citizen, they must have indefinite leave to remain in the State.

- The affordable home must be the household’s normal place of residence.

As well as the above eligibility criteria, a Scheme of Priority for households deemed eligible will apply to the scheme in the instance where there are more applicants than properties. Full details of the Scheme of Priority can be found by clicking here. The main points being;

- Property suited to the applicant household’s needs.

- Resident in county more than 12 months.

- Full time education within 70km of the dwelling.

- Employed within 70km of dwelling.

- Employed and in full time education within 70km of the dwelling.

- Am I eligible if I am not a first-time buyer?

No. Certain exemptions apply for divorced applicants.

First Buyer Exception

· separation/divorce must be legally binding

· spouse must have been allowed to remain living in the family home and

· no financial gain or proceeds must have been made by the applicant from the sale or transfer of

ownership of the family home

- What documentation is needed to support my application?

- Proof of Income:

PAYE salaried applicants must provide an up to date Salary Certificate (see attached document).

Self-employed applicant must provide Accountants Report/Audited Accounts (2 Years Required), Current Tax Balancing Statement & Current Preliminary Revenue Tax Payment Receipt.

- Evidence that applicant(s) are first time buyers – e.g. Help to Buy confirmation.

- Evidence of ability to finance the purchase – e.g. Provisional loan approval letter or online calculator showing ability to potentially borrower purchase amount.

- Proof of Residency – Utility bill/correspondence showing proof of 12 months residency within Fingal.

- Evidence of household member in education within 70KM of Lusk* – Letter from Educational Institution proving attendance.

*in the instance where there are more applicants than properties, shortlisting will occur based on the scheme of priority. Full details on the Scheme of Priority can be found by clicking here.

- How do I apply for the scheme?

Applications and supporting documents will be accepted through an online application system. The system allows for input of all relevant data and uploading of all supporting documentation. Details of the online application portal will be released.

- What are the type of properties available?

3 Bed Terraced/3 Bed Semi-Detached

3 Bed Duplex

2 Bed Apartment

- What is the cost of each type of property?

2 Bed Apt €166,000

3 Bed Duplex €206,000

3 Bed Terrace/3 Bed Semi Detached from €250,000

- How do I know which property to apply for?

The decision as to which type of property is deemed to adequately cater to the accommodation needs of a household, will be made on the following basis:

Full information can be found in the Scheme of Priority, which can viewed by clicking here.

- What is the Equity Charge/Charging Order?

One of the conditions of sale under this Scheme is that Fingal County Council will register a charge over the home for the percentage discount below market value that the home is sold for.

While the local authority’s equity share in the property must be repaid in full, the timing of the repayment(s) is flexible. After five years, the household can choose when to make repayments on the equity share and has some freedom to decide the amount it wishes to repay at a particular time. The total amount of money the household pays to clear the local authority’s equity share in the property will depend on the future market value of the home and the timing of the repayment(s). If the household is not in a position to repay the equity share earlier, the local authority will receive the value of its stake in the property when the household decides to sell the home.

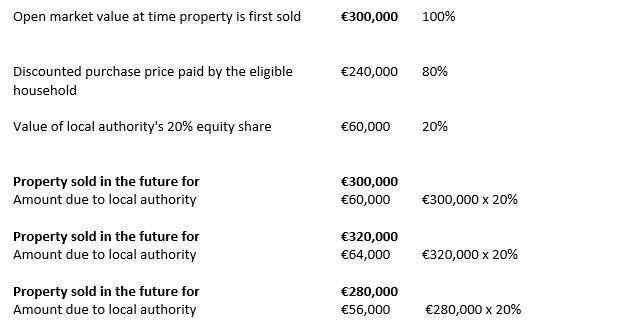

For example, if a dwelling with a market value of €300,000 is sold under this scheme for €240,000, the discount is equal to 20%. This percentage is registered as a charge on the property. If the property is sold in the future for €300,000 the amount owed to the Council is €60,000, i.e. 20% of the market value at the time of sale.

The following are illustrative examples;

Examples

Illustrative example of initial purchase price and equity share under new affordable purchase scheme;

- How do I prove that I am a First Time Buyer?

The easiest way, is to secure Help to Buy approval.

- How much deposit do I need?

While proof of a deposit is not required for this scheme, financial institutions require that a minimum 10% deposit must be raised from your own resources.

Example:

For a property with a market value of €200,000 you will need a deposit of at least €20,000.

- Can the Help-To-Buy scheme be used towards a deposit?

Yes.

- How is a decision made on my application?

The decision on your application is made by Fingal County Council in accordance with the Pilot Dun Emer Home Purchase Scheme, which can be viewed by clicking here and the Scheme of Priority, which can be viewed by clicking here.

- If I am approved for the scheme, where am I allowed to source a loan

Finance can be secured from any private lending institution like a bank or building society. Alternatively, finance can be sourced from Final County Council by way of the Rebuilding Ireland Home Loan. Details of the loan can be found at http://rebuildingirelandhomeloan.ie/

- How do I provide evidence of the ability to fund the purchase?

An Approval in Principle letter from a private financial institution or from the Fingal’s Rebuilding Ireland Home Loan should be provided. Alternatively, an online calculator showing ability to potentially borrower the purchase amount can be provided. An example of an online calculator can be found at the following link http://rebuildingirelandhomeloan.ie/calculator/

- How can I provide evidence of attendance from an educational institute?

A signed and dated letter from the educational institute is sufficient.

- How can I provide evidence that I have resided in Fingal for 12+ months?

A copy of a rental agreement, utility bill or other correspondence clearly dated is sufficient.